If you were to ask the next person you meet “Do you think Investment is important?”, I am willing to bet that most of them would reply “Yes”. However, if we were to follow up with the next question “Are you invested right now?” or “Are you investing as much as you would like?”, I believe we would get alot more ‘No’ as answers.

So why the disparity? why are people not doing what they think is important?

Well, THESE could be the reasons why:

1) underestimating the time that they have to invest (which in turn, reduces motivation to save)

2) believing that they do not have enough money to make significant impact to their financial status

3) fear of losing money

4) believing that there would be a better time to invest in the future

5) not knowing where or how to start, or who to ask

#1. underestimating the time that they have to invest (which in turn, reduces motivation to save)

If you think about it, one definite large cash need for anyone would

be money required for retirement; depending on your age, retirement would easily be 10-40 years away. But when asked about time horizon, many investors would answer that they only have a short holding period.

and this underestimation of time horizon is often the reason why people do not invest at all.

here’s the relationship: the length of time you stay invested would likely determine how much your investment grows, which would in turn affect the level of motivation to save. To illustrate this, let’s assume you make a $5,000 investment which will earn you earn you 8%p.a.

- After 5 years, your investment would have grown to 1.47 times the original amount. ($7.3k)

- After 10 years, 2.16 times ($10.8k)

- After 20 years, 4.66 times ($23.3)

- After 30 years, 10.06 times ($50.3k)

Inflation-adjusted, the motivation to save and invest would definitely be higher if we can see a more exciting finishing line. Don’t you think?

and this means that by having a more realistic view of our time horizon, we would likely be more motivated to save. One way which is useful in helping to determine your real time horizon is to compartmentalize your savings based on the intended use of it (beyond just starting different bank accounts).

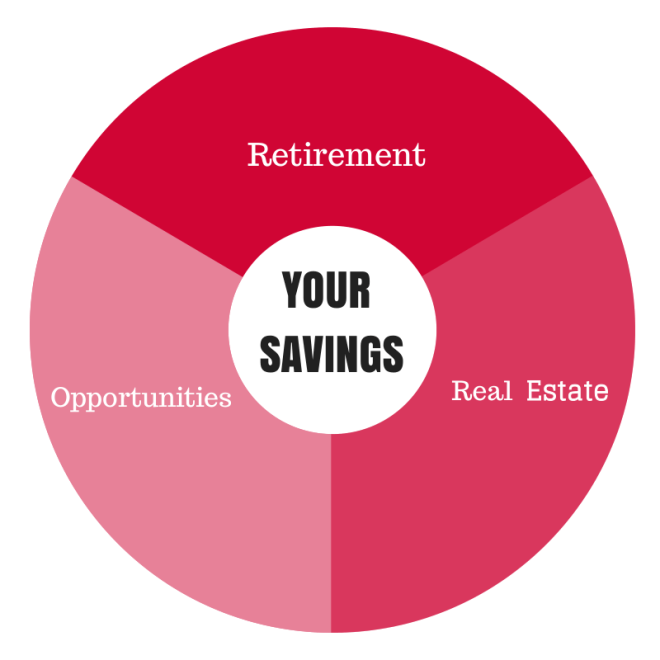

My personal categories include savings set aside for Real Estate, for Opportunities (could be business or also real estate) and Retirement (also the pot of savings with the longest time horizon). Doing so would allow you to have a better assessment of the time period that you have for each pot of savings, and in turn, eliminating the belief of not having enough time.

More importantly, this also serves as a form of risk management because it would likely prevent you from jumping into any major decisions with your entire nest egg. Likewise, it prevents us from falling into the trap of constantly reacting to life itself.

so.. still think you do not have enough time to be invested? well, think again 😉

Stay tuned for the next part of the series – Why people put of saving & investing #2″ believing that we do not have enough money to make significant impact to our financial status

Quite helpful look forth to coming back.