When it comes to financial decisions, individuals often find themselves bewildered by the myriad of options available. However, the suitability of a financial product largely depends on personal preferences and needs.

For instance, Term life insurance and whole life insurance cater to different needs; while Term life insurance provides coverage for a specific period, whole life insurance offers lifelong protection with a cash value component as a fall back. Similarly, investment options like Investment linked plans, advisor-led management, DIY investment, and robo-advisory services offer varying degrees of control, risk, and potential returns.

Personally, I have also engaged in many of these perrenial debates – with clients, colleagues and friends. Some common topics include the perrenial debates such as:

- Term Life insurance vs Whole Life Insurance

- Private Medical Insurance (private healthcare) vs Public Medical Insurance (& public healthcare)

- Saving vs Investing

- Stocking picking vs ETFs vs Unit Trust

- Investing via a pure investment platform or through an insurer through an Investment Linked Plan (no protection)

But Is There Really a “Good” or “Bad” Financial Product?

In the world of finance, decisions are rarely black and white, yet many approach them as such. This black and white fallacy can lead to oversimplification of complex financial choices, ignoring the nuances of individual circumstances. When making financial decisions, it’s common to be influenced by cognitive biases, where the complexity of a decision is reduced to a simple ‘good’ or ‘bad’ categorization.

The reality is that financial products and decisions exist on a spectrum, influenced by personal financial goals, risk tolerance, and market conditions. For instance, a financial product might be considered ‘good’ for one individual but ‘bad’ for another, based on their unique financial situation and objectives. Understanding this nuance is crucial for making informed financial decisions that align with one’s personal circumstances.

It’s essential to evaluate financial products based on their suitability to one’s financial goals and risk tolerance, rather than categorizing them as inherently ‘good’ or ‘bad’.

“The key is not to prioritize what’s on your plate but to prioritize what’s on your horizon.” – Unknown

What might be a good choice for one person could be inappropriate for another due to differences in financial situations, goals, risk appetite and most importantly, preferences.

Let’s Take The Investment Landscape as an example

Investors today face a multitude of choices, from traditional to modern investment vehicles. The investment landscape has evolved significantly, offering a range of options to suit different investor needs and preferences.

Traditional vs. Modern Investment Vehicles

Traditional investment vehicles, such as stocks, bonds, and mutual funds, have long been the cornerstone of investment portfolios. These instruments are well-established and widely understood, offering a higher level of stability and predictability. On the other hand, highly sector specific exchange-traded funds (ETFs), cryptocurrencies, quant and alternative investments, represent a newer, more innovative approach to investing.

A young investor may find investing in cryptocurrency a suitable wealth creation vehicle for himself but the same investment would be beyond the risk appetite of someone in their pre-retirement years.

The Role of Technology in Changing Investment Access. DIY vs Roboadvisory vs Advisor Led

Technology has completely reshaped the investment landscape. With online platforms, mobile apps, and robo-advisors, investing has never been more accessible—or affordable. These tools have opened the door for a new generation of investors to jump in with ease.

But here’s the catch: access alone doesn’t guarantee success.

If you’re not clear about your financial goals, the best app in the world won’t help you hit them. That’s where advisor-led management comes in. Think of it as working with a coach—someone who helps you build a plan, avoid costly mistakes, and stay on track when the markets (or emotions) run wild. It’s a game-changer for those who don’t have the time, know-how, or confidence to go it alone.

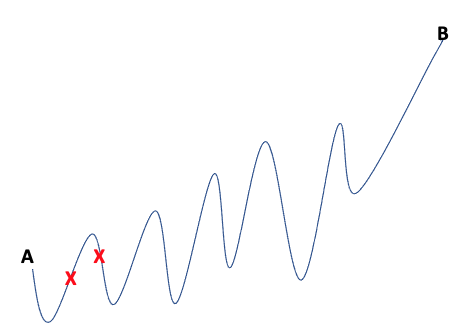

For the DIY crowd—it’s absolutely possible to succeed. But it means doing the research, staying disciplined, and not panicking when markets dip. It’s like getting fit on your own: some people crush it with YouTube workouts and meal plans. Others need gym buddies for motivation. And for some, hiring a personal trainer makes all the difference.

Bottom line? The best approach is the one that matches your personality, time, and goals. But just like fitness, having a plan—and sticking to it—makes all the difference.

Investment-Linked Plans (non-protection options):

ILPs are often misunderstood, and their reputation has taken a hit—largely because of past cases of misrepresentation and mis-selling, rather than the product itself. When structured and explained properly, they can actually be a powerful tool for long-term planning.

One of the most important things to understand about Investment-Linked Plans (ILPs) is their fee and bonus structure. These plans come with a mix of charges and rewards—and not all ILPs are created equal.

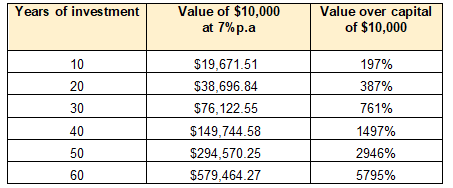

Some have higher upfront fees but offer generous loyalty bonuses later. Others might have lower ongoing costs but fewer long-term perks. That’s why it’s critical to compare the details before jumping in—because the right ILP can help you grow your money, more effectively.

But here’s the key takeaway: Insurers love commitment. Many ILPs are designed to reward investors who stay the course—whether it’s through bonus units, lower charges / capped charges over time, or both. So if you’ve got a long investment horizon and the discipline to stick with it, an ILP might actually work harder for you than you think. On the other hand, if you are only looking to invest for a very short period of time – or if it is highly likely that you may need the money for reinvestment in other asset class (such as property purchase), then this is almost definitely a vehicle to stay away from.

Other standout features can be really helpful in supporting real-life needs—especially when it comes to retirement and legacy planning.

For one, ILPs makes it seamless to pass on your investment to a loved one in the event of your passing. Instead of going through a lengthy probate process, the proceeds can be directed straight to your nominated beneficiary. This ensures your loved ones receive support quickly—when they need it most.

On top of that, some ILPs also allow you to set up targeted withdrawals during retirement, so you can enjoy a steady stream of income while keeping the rest of your money invested. Whether it’s drawing down a set amount monthly or tapping into it for specific milestones, the flexibility is built in. You’re in control, not the market. In short, it’s not just about investing—it’s about making your money work around your life, not the other way around.

Conclusion: Beyond “Good” and “Bad” in Financial Planning

Ultimately, effective financial planning is about finding the right fit. It’s about moving beyond the notion of “good” or “bad” financial products and focusing on financial product suitability. By doing so, individuals can create a tailored financial plan that meets their unique needs and goals, leading to a more secure financial future.