Parents of young children frequently ask me a recurring question: “What is the best approach to teach my kids about personal finance?” While the task itself may not be overly challenging, finding an enjoyable and non-materialistic approach can be. To tackle this, I have begun exploring a different way by focusing on teaching children the concept of “resource planning” instead of purely financial planning.

And the resource? SNACKS.

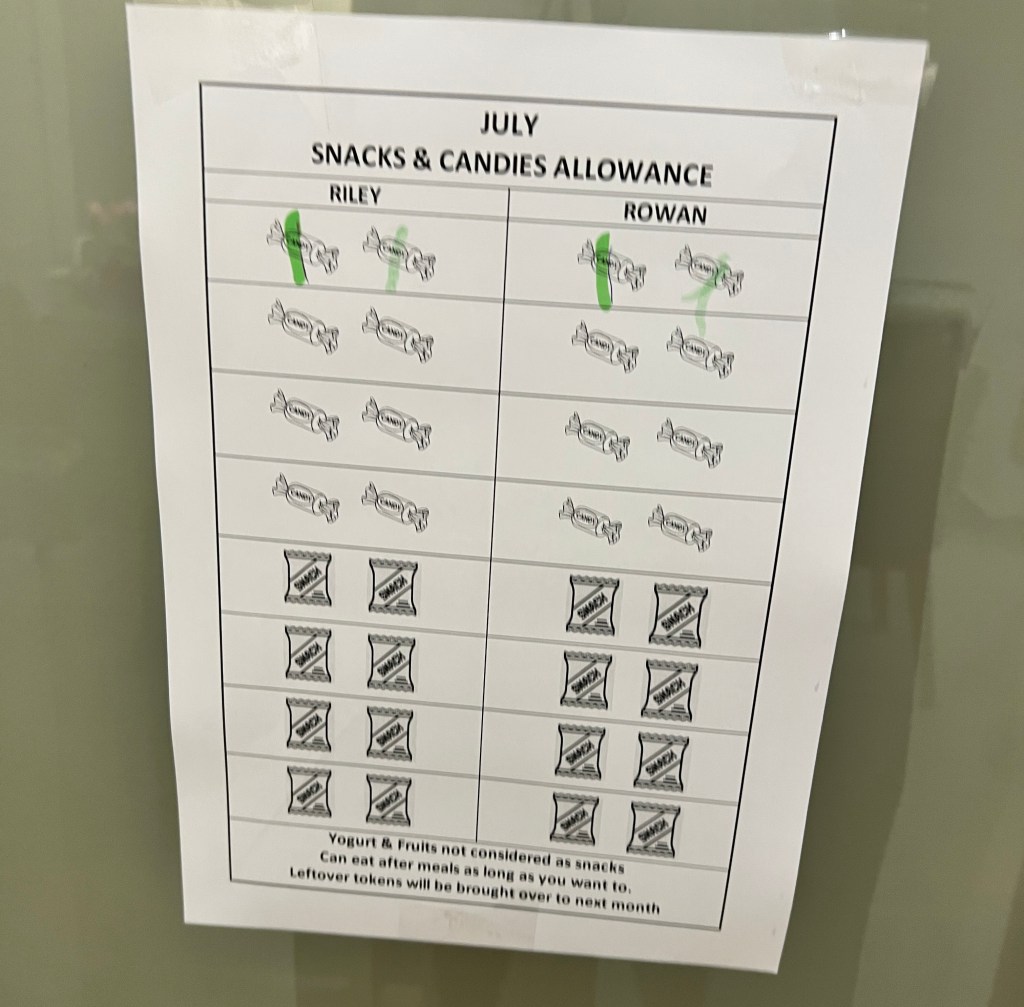

My kids (Riley & Rowan) are now on a Snack Budget. They receive a limited amount of snacks per month and they are allowed to make their own choices on when/what they want to eat. So far, I think it’s been fairly effective. It instils responsibility AND it saves me my sanity. I no longer have to deal with their constant requests for snacks. Here is a short summary of the steps involved in this approach:

1. Explain the concept: Start by explaining the idea of limited resources, budgeting and allocation. Explain it through themes such as Time, Money & Resource (in this case, snacks).

2. Set a monthly snack allowance: Determine a reasonable amount of snacks that your child can have in a month. This could be a fixed number. You can also set some rules. For example, snacks are only allowed after breakfast, or snacks are only allowed to be taken out from a dedicated snack box. (It will also be wise to keep a higher proportion of quality snacks at home, to manage the diet).

3. Track and plan: Help your kids create a simple tracking system, such as a chart or a notebook. Personally, I print this out for them. Every time they grab a snack, they would have to cross out one ‘token’. The snack tokens only get replenished at the start of the next month.

If your kids older:

4. Involve them in the shopping: Take them along when grocery shopping and involve them in making choices. Give them an allowance ($), and allow them to choose their own snacks. This will help them understand the value of money and the importance of making good choices.

5. Encourage saving: Teach your child the benefits of saving money. If they manage to have some snacks left at the end of the month, encourage them to save that extra amount for future goals or treats.

By teaching children budgeting through limited snack allowances, they can learn valuable lessons about money management & making choices. This approach can lay a strong foundation for their financial & personal well-being in the future.

If you try this and it works, do drop me a note too. would love to hear more about it 😉