First and foremost, it is good to be back after a long hiatus from writing. Work and life’s been busy. Over the course of last year, I have held seminars at various corporations, from online retailer Zalora, to hotels such at M Hotel and other professional services firms such as NICE Systems, Perennial Real Estate etc. But now that things and processes are more settled, I’m glad to be back here 🙂

I have also made some other ‘progress’ in life. After finding my beloved, we also purchased our first residential home, got married, and I am also now hosting a little bun in the oven.

so what’s better to write about, but this?

Of course, it is still a little premature for me to be writing about this since it is still months before the little one will be born. but seeing how this is now a common topic amongst my peers- some who just turned mummies and some who are becoming mummies, I feel like now would be the best time to start the series. What insurance will my newborn need?

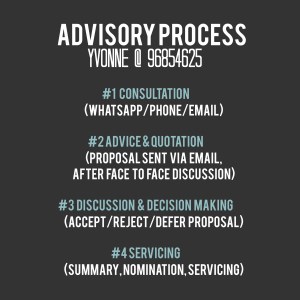

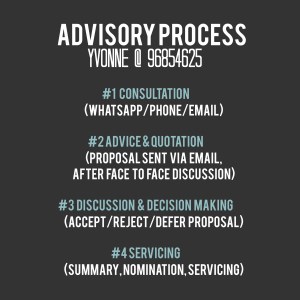

(i will not be talking about the prenatal maternity insurance here, but you can text me separately to find out my view on it, and to find out which plan is the most ideal. For the newly weds who are excited about family planning and want to know more about the International Health Plans that cover for delivery costs, feel free to just give me a call too)

So first off…

This is perhaps, the most straightforward and important insurance to get for our children. Upon birth, your child will be covered under the Medishield Life Scheme, which is the nation’s health insurance.

Medishield Life covers for Government Hospitals for B2/C wards, and limits of coverage and co-payment applies. So most parents would enhance the child’s coverage to a Private Medical Integrated Shield Plan that cover the child fully, from Govt to Private hospitals, thereby transferring the financial obligations to the insurer in the event of hospitalisation (be it due to high fever/ any unfortunate complication when young).

Enrolling our newborn when they are young is also crucial because more likely than not, they would be at their healthiest stage, with no prior medical records/conditions.

There are 6 different insurers in Singapore providing Private Medical Integrated Shield Plan and each insurer provides the coverage via 2 parts – Main Plan (takes care of almost 90% of bill) and Rider Plan (takes care of the remaining 10% of bill + other benefits).

Below is a simple comparison on the relative strength on each plan (based on private as-charged cover with rider). Because it is still best to discuss this in detail with an advisor to find out what is best for you, I have excluded the names of the insurers specifically. Drop me a whatsapp and i’ll be happy to share in great detail about it.

Disclaimer: Info correct as of date of post.

private medical insurance all provide a good level of coverage for the most important of matters. Insurers with red cells simply have the worst relative coverage, but not poor coverage on its own. There are pros and cons for each insurer and it would be ideal to speak to your adviser to find out which serves you best. The plans stated here do not include international health plans.

So here it is, the first part of the <What insurance to get for your newborn?> series. Do look out for more in the coming week 🙂

and for my dear friends and clients who are reading this, if you have had good experience with how I have assisted you with your finances (be it for insurance or investment), do share this article and my services with your loved ones too. So I know that I have been doing the right thing and can continue doing it for more people.

And for those who are reading this and may be shy to ask more, please do not be. Regardless of whether we set up a advisor-client relationship or not, I will always be more than happy to share. likewise, just drop me a FB message/text.

Unknown to many, CPF actually has the special needs saving scheme that can help parents of children with special needs to save for their long-term care needs. Parents can nominate their children to receive monthly disbursements from the parent’s CPF savings after death. This scheme is administered by the Special Needs Trust Co and is probably worth looking at if of relevance.

Unknown to many, CPF actually has the special needs saving scheme that can help parents of children with special needs to save for their long-term care needs. Parents can nominate their children to receive monthly disbursements from the parent’s CPF savings after death. This scheme is administered by the Special Needs Trust Co and is probably worth looking at if of relevance.