We’ve all heard this story before, where coffee used to cost 90 cents, now it’s $1.20. That is a whopping 33% increase! However, no one becomes a millionaire by being thrifty with coffee, so why should we be bothered by inflation?

Inflation is the sustained increase of prices in goods and services arising from 2 main causes:

1) Cost-push inflation

An example of such would be, an increase in the price of fuel causing your Grab ride to be more expensive.

2) Demand-pull inflation

An increase in demand for a particular product causes an opportunistic increase in the raw material and skilled labour required to produce it.

As Singapore depends on our neighbouring countries to provide us with what we need, we are susceptible to the ebb and flow of external markets. The Consumer Price Index (CPI) in Singapore has shown us:

– As of 23rd December 2021, inflation was at 3.8% year on year, the highest in 8 years

– Electricity costs have increased by 10.7% in December 2021

– Electricity costs have further increased by 17.2% in January 2021 (just check your bill)

– As of 23rd February 2022, inflation increased further 2.4% year on year, the highest in 9 years.

This will likely be further exacerbated by the current Russian-Ukraine situation.

So what can we do?

1) Create Multiple Income Streams

Some would call it a side hustle, or a side gig. It is not enough to depend solely on 1 income source, even Warren Buffett seconds this. “Never depend on a single source of income” – Warren Buffett“. This provides us a certain degree of protection if the main source of income diminishes.

2) Start investing

The 2nd half of Warren Buffett’s quote reminds us that we can never start investing too early to have a second income source. And as we all know, time in the market trumps timing the market. Having a long time horizon is probably the best way to ensure that you are able to ride through volatility and have an average rate of return that trumps the long term inflation rate.

3) Every dollar counts

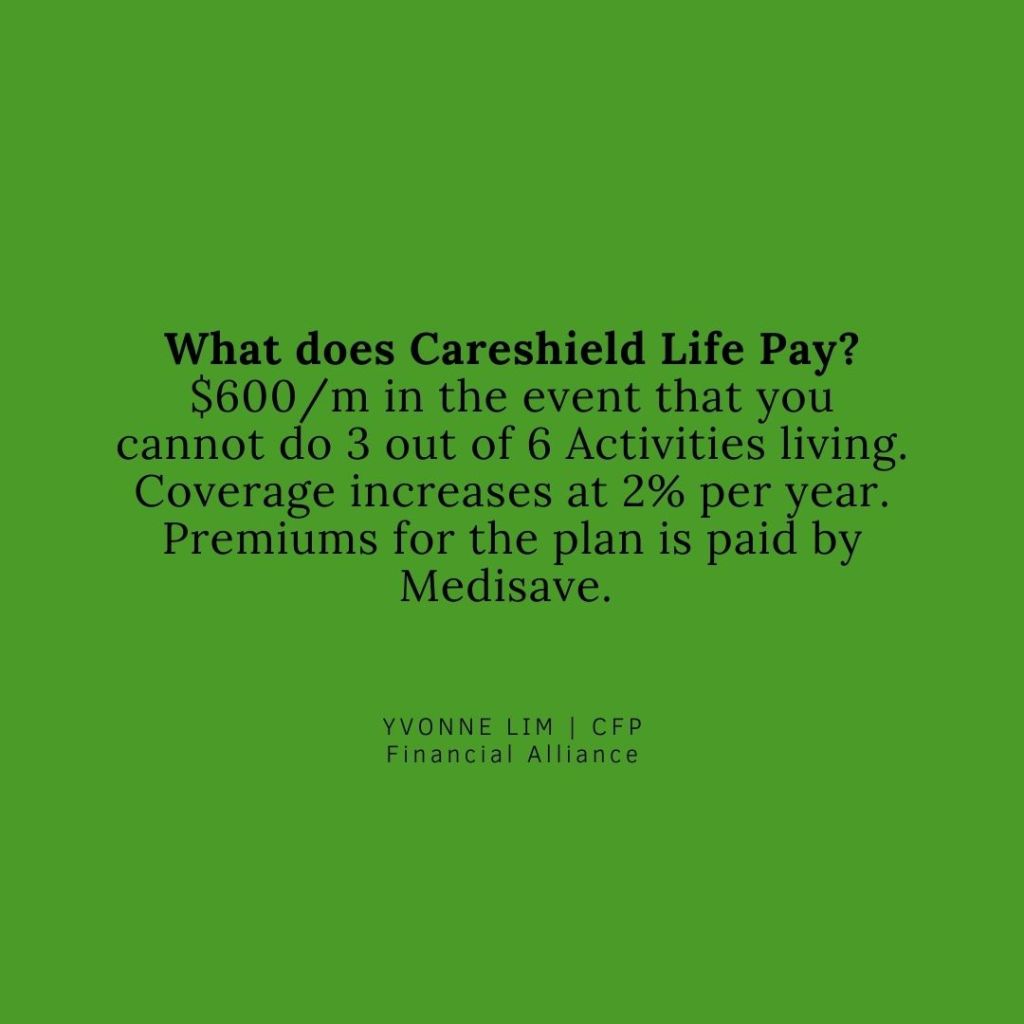

Reassess your savings accounts, CPF, SRS accounts, Fixed Deposits, insurance policies. Sometimes, all we have to do is to reallocate our resources into the right place. While doing this, it is also important to take into account government policies and your entitlements to maximise your return (and this can be totally risk free).

Like to review your overall financial health? Drop me a WhatsApp for an introductory call on my advisory services.