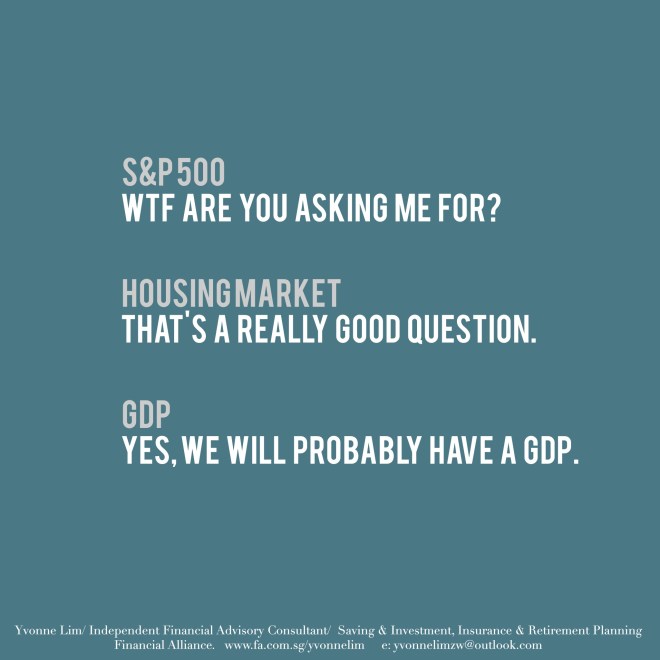

‘Market Forecast’ by Barry Ritholtz. This has got to be the best forecast.

Full article: http://www.businessinsider.com/barry-ritholtz-2014-market-predictions-2013-12

Jokes aside, I think the key is that we can never be too certain about what’s ahead or be 100% sure of what’s going to happen and at which point in time. Aptly put, the better way is to make short-term, tactical adjustments while keeping to the long-term, strategic investment plan.

and this too, is our guiding principle for investment portfolio management.