As we conclude the festivities of the new year, an intriguing question has been raised by many of my clients: What should be done with children’s Ang Bao Monies? Our recommendation? Invest it. And for those without children, consider investing for your own future if you haven’t already done so.

Benefit 1: Providing a Head Start

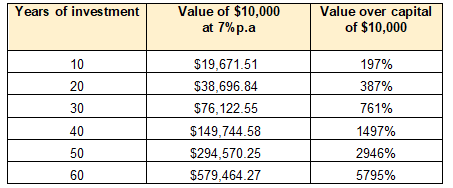

One of the greatest advantages our children possess is time, and investing their Ang Bao or birthday money could prove to be one of the most prudent decisions. While money can be replenished, time is finite. Albert Einstein famously remarked, “Compound interest is the eighth wonder of the world.” By initiating investments at an early age, there is the potential to significantly augment their wealth. Even with conservative estimates, the power of compounding over time can yield substantial returns.

Benefit 2: Fostering Financial Literacy and Exposure to Market Dynamics

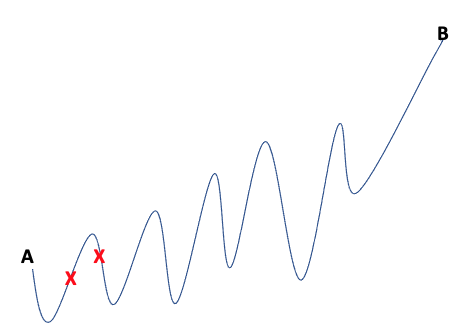

Financial markets are inherently volatile. Introducing children to investment early on exposes them to the realities of market fluctuations, instilling in them the understanding that the path to financial growth is seldom linear. This exposure cultivates resilience and equips them with the mindset to make informed, rational decisions, devoid of emotional biases. Moreover, discussions surrounding investments open avenues to explore various businesses and industries, igniting curiosity and potentially uncovering their passions.

Benefit 3: Cultivating a Positive Relationship with Wealth

For many children, money is synonymous with immediate gratification – a means to acquire possessions or experiences. By introducing the concept of investment, we shift the paradigm from scarcity to abundance. Through prudent financial decisions, we demonstrate the potential for sustainable growth and the ability to create value not just for oneself, but for others as well.

If you wish to find out more about starting an investment account for your children (or for yourself if you haven’t), do drop me a whatsapp/email.

Yvonne Lim

Certified Financial Planner

Representing IFA, Financial Alliance

Original Post here: