a financial review when the outlook of the economy is gloomy is more important than financial planning when things are rosy.

When times are bad (note that the list is not exhaustive):

- Our income may be affected.

- The risk of unemployment goes up.

- Pay cuts happen.

- Contract workers may not get renewed

- Drop in revenue (affects business owners)

- Expenses may go up

- Think rent, mortgages, petrol and even food prices. There are many news regarding this recently so I shall not elaborate.

- Think rent, mortgages, petrol and even food prices. There are many news regarding this recently so I shall not elaborate.

- Tougher borrowing terms

- You may not be able to get financing easily

- In the event of a drop in asset prices/loss of income, you may not even be able to refinance your loans

A financial review will help you assess your capacity to deal with any of the above scenarios, and allow you to make adjustments to improve your situation.

And step 1: awareness on your spending habits. What are you REALLY spending on?

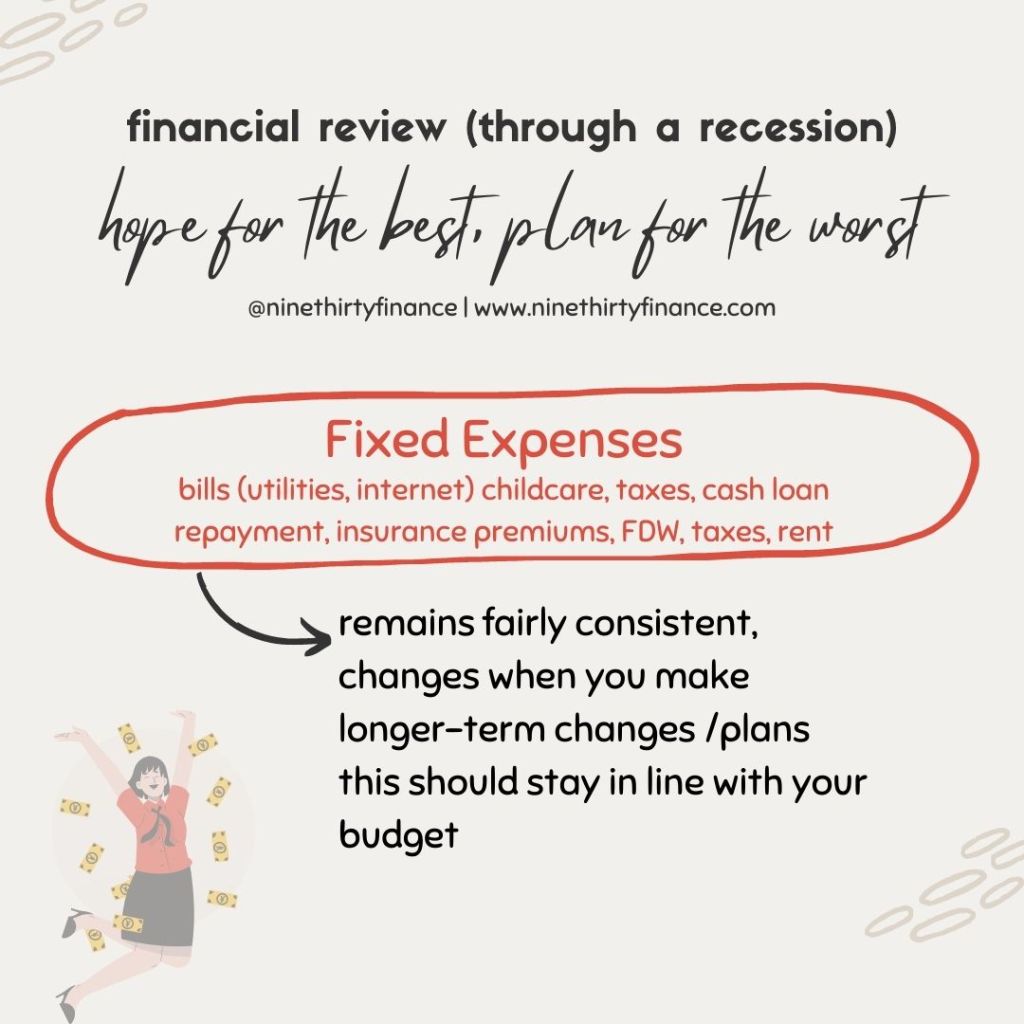

First, calculate your monthly fixed expenses. This includes bills and payments which HAVE to be paid and which remain fairly consistent in the short term – this means you can’t just make huge cuts just because you want to.

Think rent & mortgage repayments- even if you were to make lifestyle choices and move to a more modest home, the process takes time.

This is also the reason why the government has the mortgage servicing ratio and total debt servicing ratio in place to ensure financial prudence.

If a huge chunk of your income is going to fixed expenses, you may find yourself in a more stressful situation in the event of a pay cut/unemployment as it would require you to make major lifestyle changes to bring down the expense to fit the budget (or a smaller income)

To mitigate this, keep enough emergency cash or have a plan that can buy you time (such as renting out a room in the house, moving in with your parents temporary, exercising retrenchment benefits/premium holiday on your insurance plans).

Next up, calculate your monthly variable expenses. This includes discretionary spending that can be reduced easily.

- Food – Dining in vs preparing your own meals

For some people, dining out could be cheaper as it may not be cost effective to cook for one. For others, having their meals at home can save a huge chunk. - Transport – Public transport vs driving/taking the taxi

and the list goes on.

The good news if a large part of your income goes to discretionary spending is that you can easily make adjustments when times are bad. The bad news is that human beings are creatures of habit and it can be painful to change your spending habits overnight.

If you are working in a high risk sector, you may want to start assessing your spending habits in order to be better prepared.

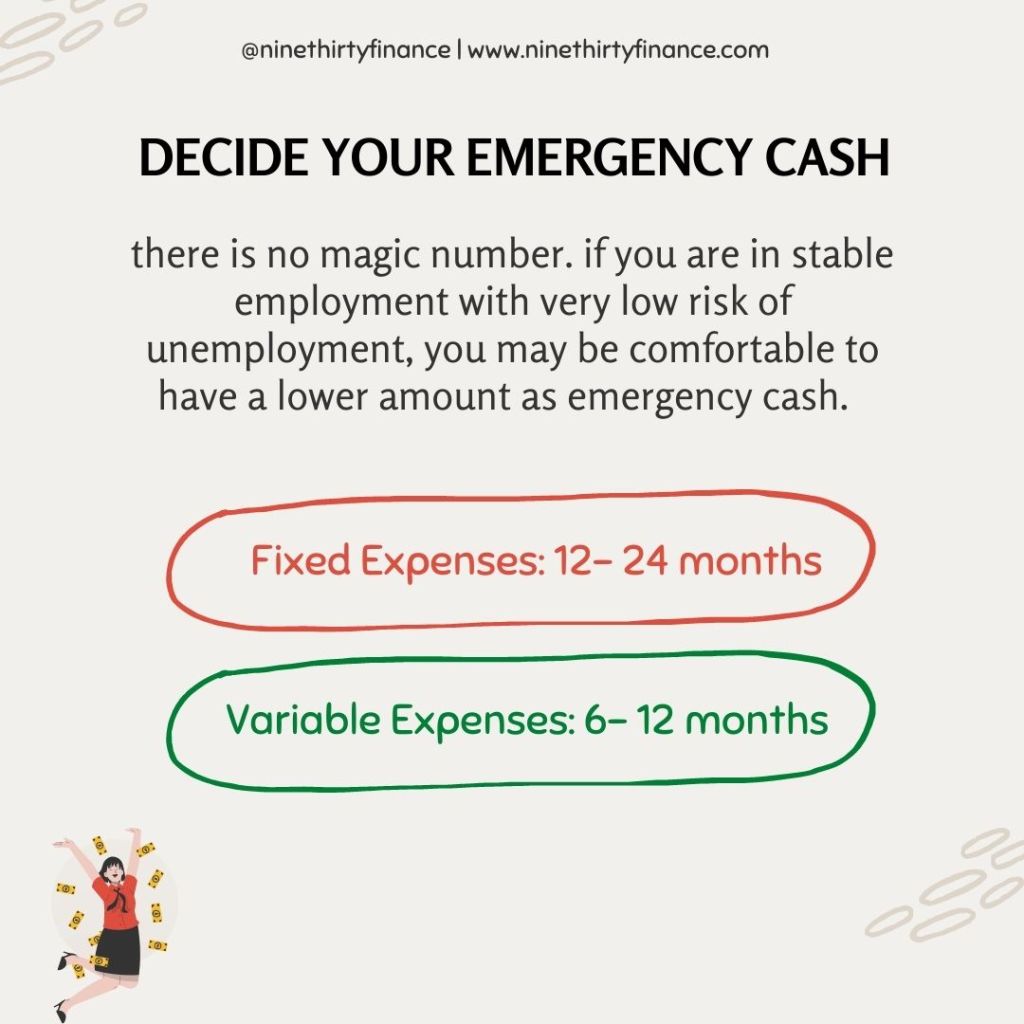

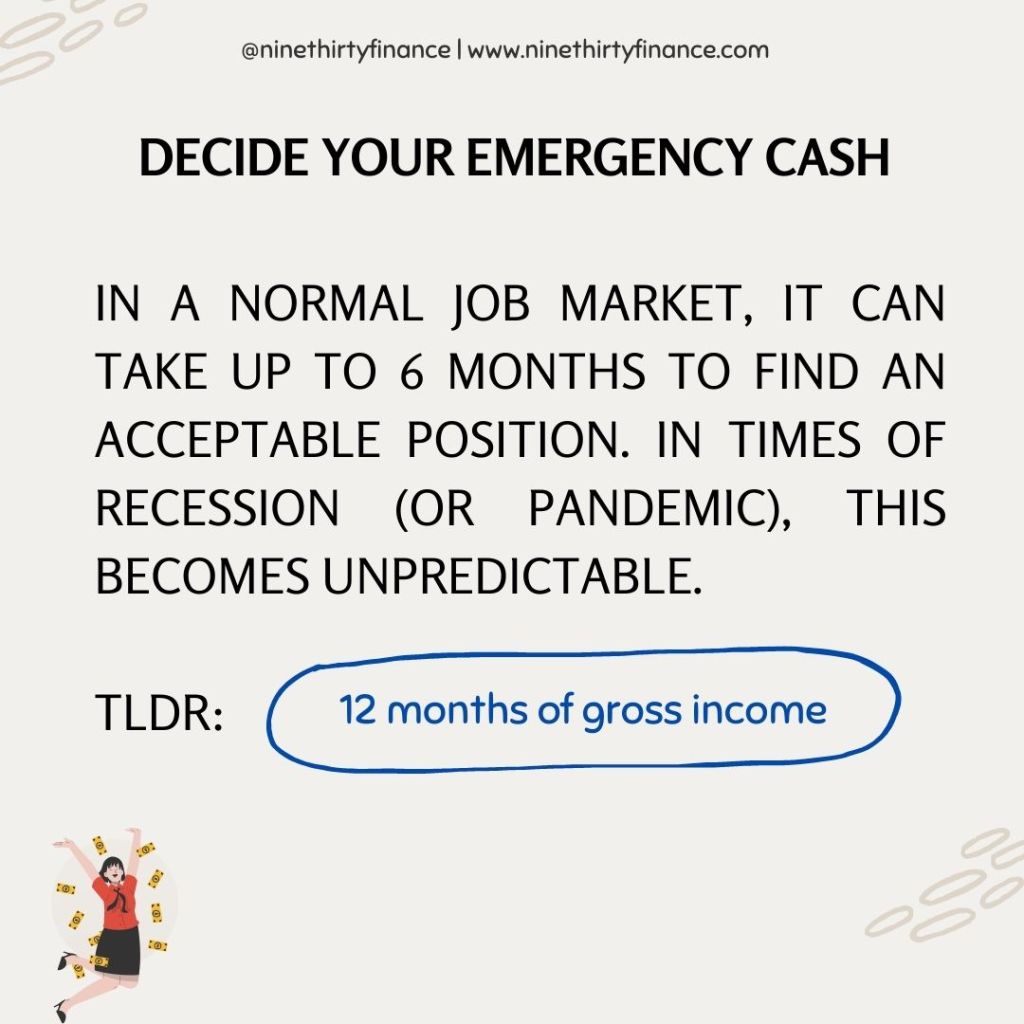

The whole point of calculating your expenses? To help you determine the level of emergency cash to keep. (No, I do not think that the commonly advocated emergency cash of 3-6 months expense is sufficient)

Example:

Monthly Fixed Expenses: $5000

Monthly Variable Expenses: $3000

Total Emergency cash to keep: $5000 * 12 + $3000*6 = $78,000

Of course, if you still aren’t convinced to do this ‘tracking exercise’, just keep 12 months of your income as emergency cash.

The Singapore Savings Bonds is currently giving a high interest rate of ~3.4%p.a. As it is a highly liquid vehicle, it is a great vehicle to use to hold your emergency cash. And the reason why I advocate this over FD/T-bills is because i do not believe that interest will stay at a high level (not 10 years, anyway) perpetually.

more on that in my future post 😉