Recently, a friend was referred to me for financial planning and it was an easy session because he already knew what he had to do- to first stop drinking (alcohol) so much, because he had other goals that he wants to pursue.

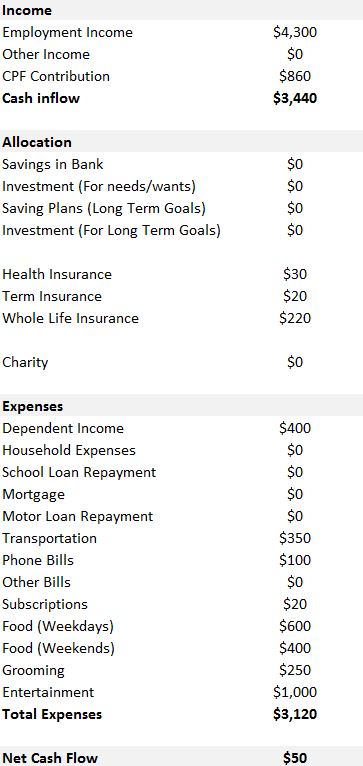

Here’s a breakdown on his cash flow (income allocation).

At the moment, he has $7k in savings and no investment. so honestly, you don’t need a financial planner to figure the following out

The downsides of his situation:

- Not enough cash (Low liquidity/emergency cash)

- Not investing enough

- Not saving enough

- Lack stability

It’s a zero sum game so there’s no magic to this. He will have to save more and likely from all his casual drinking sessions. It’s not gonna be a fast transition to financial freedom – he will have to first develop healthier cash flow management habits, and then gradually get into a healthier financial situation.

The upsides of his situation:

- No liabilities

- Dependents do not require his support at the moment.

- Earns a decent income (he just started working not too long ago)

This is the edge of being an young adult. If you are lucky, you are not bogged down by any loans and your commitment to others (dependents) would still be minimal. So basically, you already have the ticket to fly – to start a business, explore opportunities, do something/anything crazy.

But very often, this comes with prerequisites, you need to have the confidence to embark on the above. That is, a basic level of financial stability is required before you get the ticket to the opportunities out in the world. After all, living on bread and water to pursue a dream is unlikely what you would choose to do, over a long-term basis.

And most importantly, as the old (cliche) saying goes, Cash is Prince, Cash Flow is King. Regardless of what you embark on, cash flow management could be one of the first and most important skill to acquire.

For the young adults, it’s really fairly simple (simple, not easy)

- Know your future intentions and what you want to do with your life.

- Work out the numbers and direct your saving efforts towards your intentions/goals

- Choose the right vehicles.

For myself, I generally save for short term goals and invest for longer term goals. There are plenty of vehicles out in the market. Choose one that works for you. - Stick to it. That is, save first, spend what’s left.

- Continue to enjoy life

That’s all folks, for my fellow young adults out there.